form 8915 e instructions turbotax

Generate the Form 8915-e TurboTax to report. With those relief measures the IRS released Form 8915-E.

National Association Of Tax Professionals Blog

The form 8915-e TurboTax was only for the tax year 2020.

. Generate the Form 8915-e TurboTax to. The information from Form 8915-E and 8915-F will be e. That Typically takes the IRS 2-3 weeks.

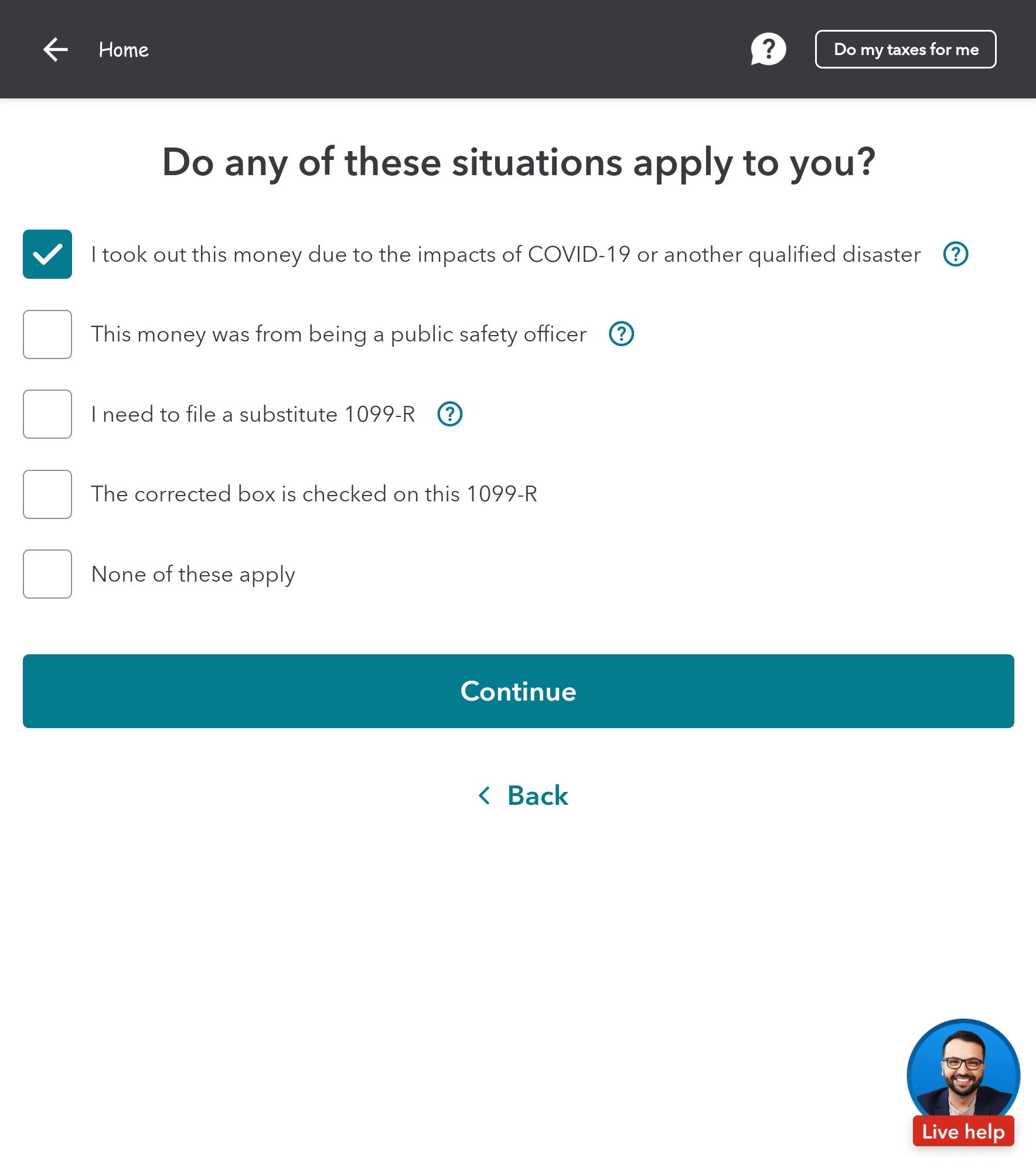

Form 8915 E Form 5329 Instructions Exception Information For Irs Form 5329 Irs Issues Form. The IRS gave favorable tax treatment up to 100000 for coronavirus-related distributions from retirement plans including IRAs 401k and 403b. The relief allows taxpayers to access retirement savings earlier than they normally would be able to.

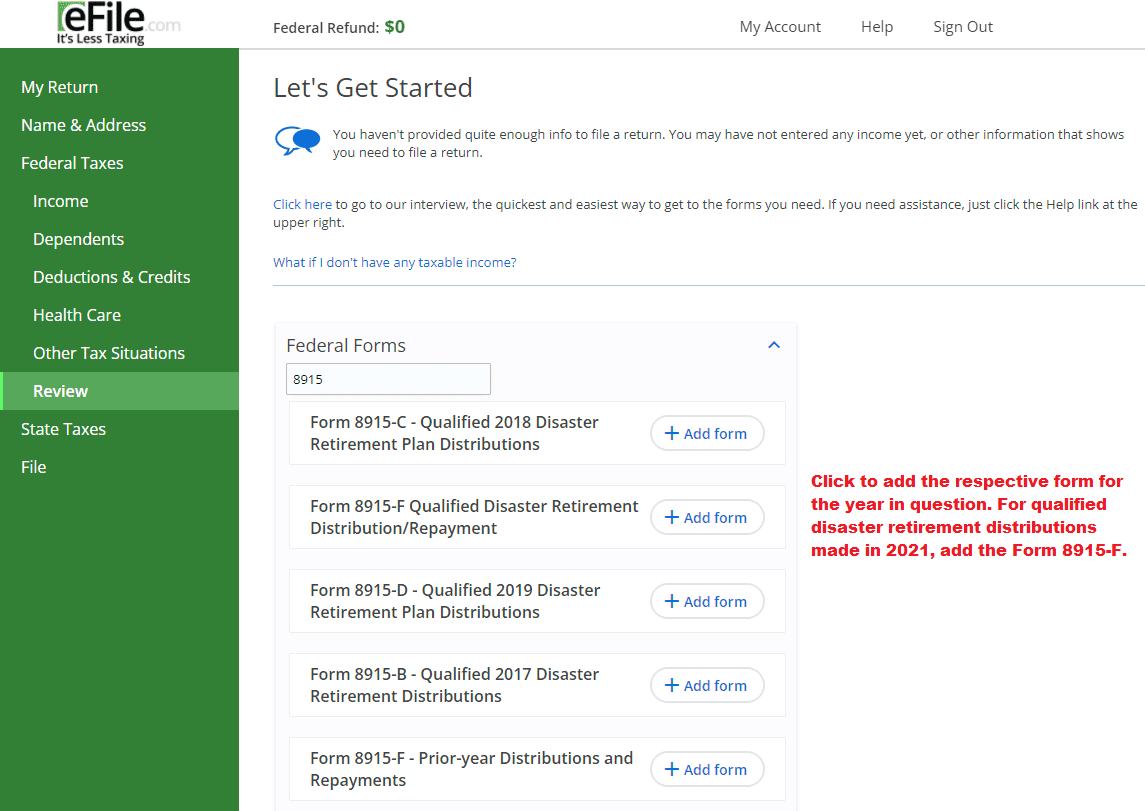

Sign in to your TurboTax account. Open or download your 2020 tax return PDF. Forms 8915 are available in Drake Tax.

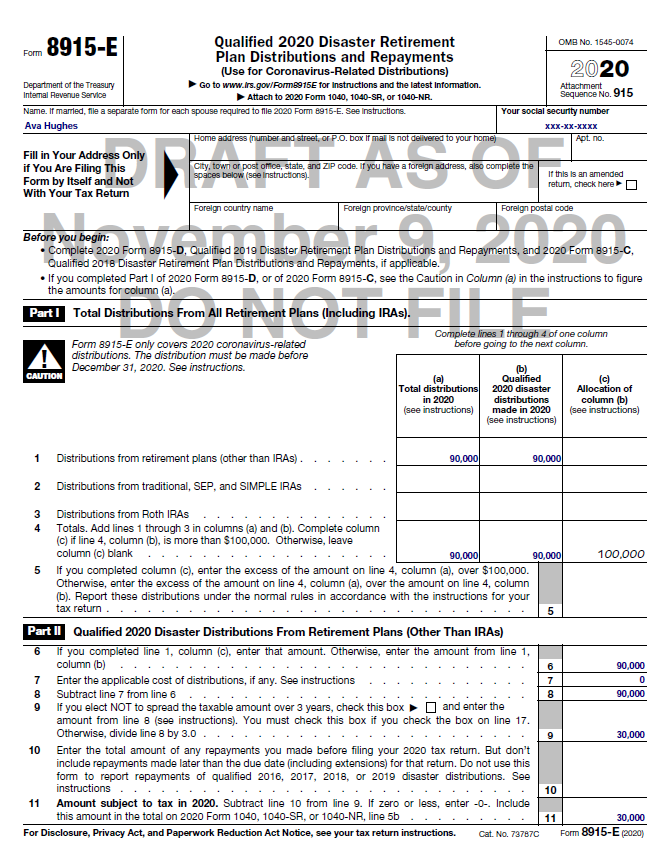

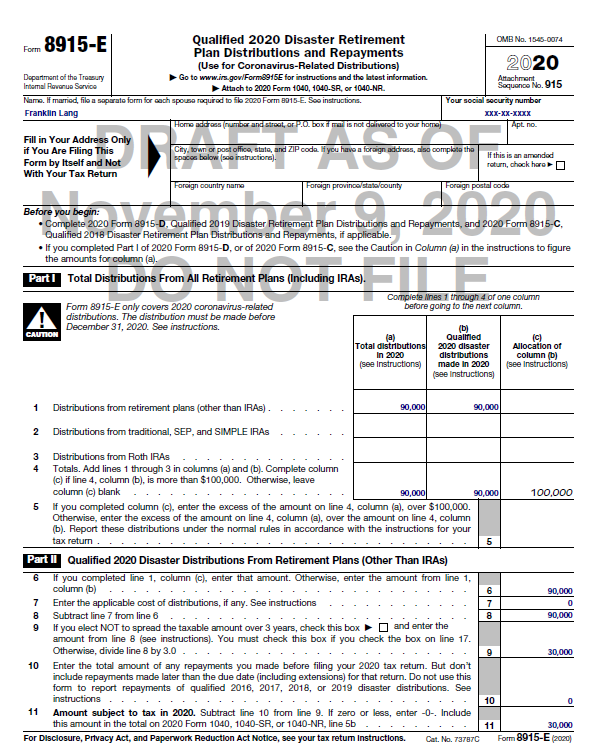

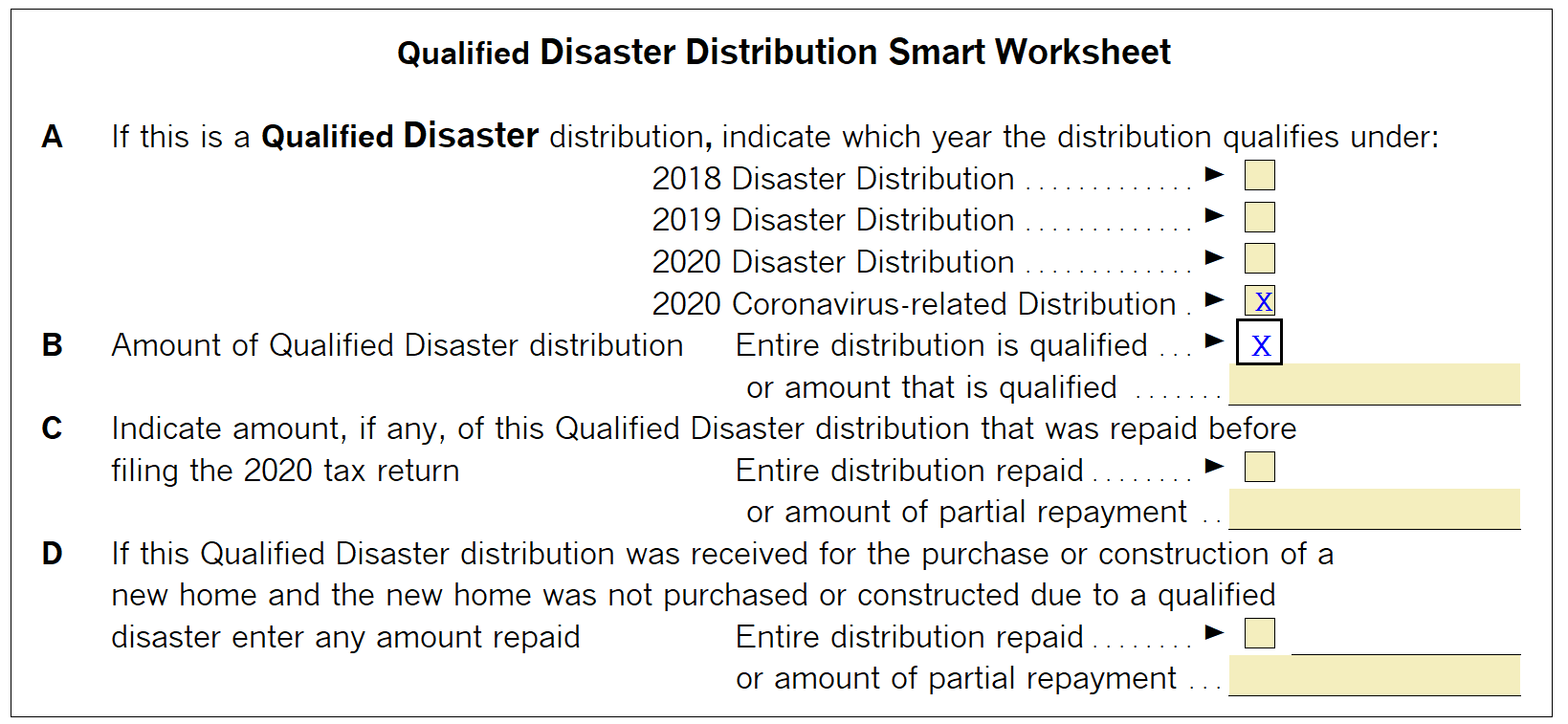

Information about Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Use for Coronavirus-Related and Other Qualified 2020 Disaster. Examine Form 8915-E to see the amount that is taxable on your 2020 tax return and look at Form 1040 lines 4b and 5b to see that the taxable amounts determined on Form 8915-E is propagating to Form 1040. Please be aware that these.

The virus SARS-CoV-2 or coronavirus disease 2019 referred to collectively in these instructions as coronavirus is one of the qualified 2020 disasters reportable on Form 8915-E. The information from Form 8915-E and 8915-F will be e. The only way that you could split the remaining 55 over 3 years would be to treat only 55 of the distribution as a CRD.

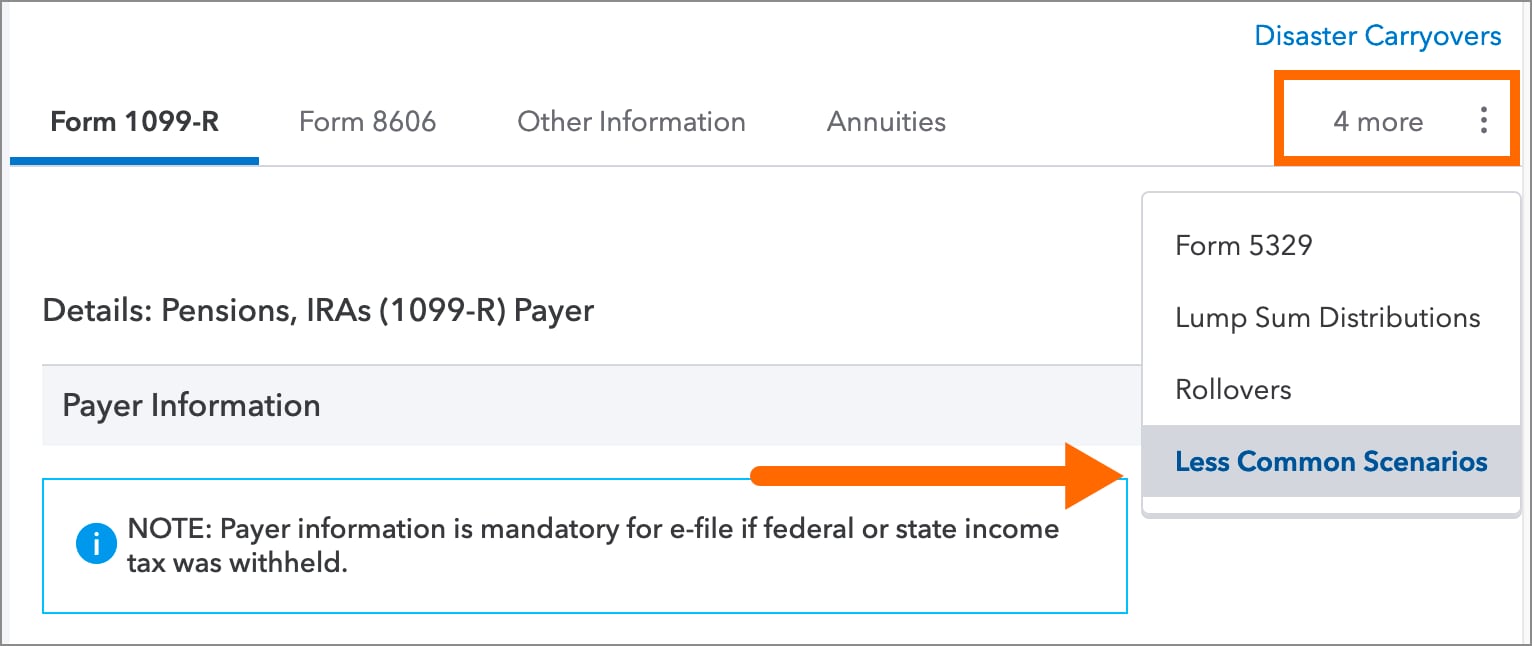

If you took a distribution from a retirement plan other than an IRA follow these instructions. In tax year 2021 the 8915-E is a worksheet will show the distribution and track the information to generate the 8915-F. See below for a link to sign up for an email when the form is ready.

If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year. Generate the Form 8915-e TurboTax to. The TurboTax 8915-E should be available on Feb.

What You Need To Know About Coronavirus Related Distributions Before Filing Your 2020 Tax Return

Tweets With Replies By Turbotax Support Teamturbotax Twitter

Cannot Check Box For Covid On Form 8915e S Or T

Coronavirus Related Distributions Via Form 8915

Turbo Tax Revisit This Area Later R Tax

Irs Instructions 8915 Fill Out And Sign Printable Pdf Template Signnow

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Taxes On Cares Act Ira Withdrawals Form 8915 E Youtube

Solved I Received An Early Withdrawal Of My Retirement Account Due To Covid When Will Software Be Updated To Include Irs Laws For This

/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor

Generating Form 8915 In Proseries

Form 5329 Instructions Exception Information For Irs Form 5329

How To Enter Coronavirus Related Retirement Plan Distributions In Proconnect

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 23